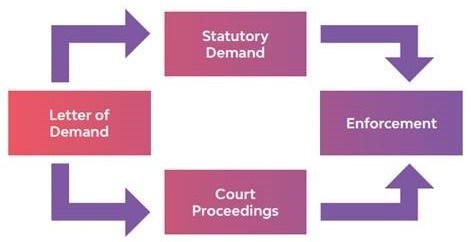

Debt Recovery Pathway

Securing money owed to you can be time consuming, frustrating and ultimately futile if your options are not clearly understood. Whether you are a small business, large corporation or an individual, we are experts in helping clients recover money that is owed to them. Utilising the legal remedies available to you, we create workable solutions to each unique situation. We pursue both formal and informal channels until a satisfactory outcome is reached.

We are now offering a complete online debt recovery service which will provide new and existing clients with a cost-effective, convenient and efficient way to recover debts, and allow you to consider your available options.

The process is:

Your options are:

Letter of Demand

The first step of the debt recovery process, this formal letter of demand clearly and concisely sets out:

-

the basis for the debt (such as an invoice or contractual right to payment)

-

the amount of the debt

-

a demand for payment within a set period of time.

The letter of demand is a quick and easy way to recover an outstanding debt. We find this often results in the debtor taking the matter seriously and making payment (or arranging payment). The failure to meet a formal demand can be important for any future litigation in demonstrating that the debt remains due and payable and can also be an important factor in claiming the costs of proceedings.

Statutory demand

If the debt is $4,000 or greater, an alternative to a letter of demand is to issue a statutory demand to the debtor (provided the debtor is a company).

From the date of service of the statutory demand, the creditor has 21 days to make payment. Once served, the debtor is required to either meet the demand or apply to set it aside. Failure to comply with the demand allows the creditor to make an application to the Court to wind up the debtor in insolvency.

Statutory demands are the most effective in situations where a judgment has already been obtained, and the demand is used as an enforcement tool.

Court proceedings

If a letter of demand is not answered and if alternative dispute resolution is unsuccessful, the creditor should promptly consider commencing recovery proceedings in Court.

If you obtain judgment from the court, you will then be entitled to enforce that judgment in the event payment of the judgment debt is not forthcoming.

To take advantage of our debt recovery service, please complete the form below which will guide you through the best debt recovery pathway for your circumstance.